A second round of funding worth $310 billion for the Paycheck Protection Program (PPP) was signed into law on April 24, 2020 and the SBA resumed accepting applications from participating lenders on April 27, 2020. According to the SBA’s PPP Round 2 Report, the overall average loan size for approvals from April 27, 2020 through May 1, 2020 is $79,000. The total value of the 2.2 million loans approved as of May 1 is over $175 billion.

One of the most attractive features of the PPP is the borrower’s eligibility for loan forgiveness. But as more applications are approved, funds disbursed, and the 8-week clock begins ticking, more and more small businesses are wondering about the loan forgiveness process. The SBA and Treasury Department have been releasing updates to a growing list of frequently asked questions about the PPP, but formal guidance on forgiveness has not yet been issued.

Though a popular source of funding, the PPP is complicated and businesses must be prepared to adapt as new rules and clarifications are issued. If your business is lucky enough to get approval for a PPP loan, it’s crucial to thoroughly understand the rules for qualification and forgiveness to avoid potential pitfalls. Here’s a quick review of the PPP loan forgiveness basics:

-

PPP loan can be used for: Qualifying expenses, 75% of the loan amount must be spent on payroll costs (salary and benefits) and 25% can be used for mortgage interest, rent, and utilities

-

Loan amounts: Up to $10 million, maximum of 2.5x average monthly payroll

-

Terms: Up to 100% forgivable, unforgiven amounts must be paid back in 2 years at 1 percent interest, with no payment due for the first 6 months

Watch our recorded webinar, COVID-19: Maximize your PPP Loan Forgiveness, for more information.

Top five questions you asked about PPP forgiveness

At Asure, we’ve received many questions from small business owners and entrepreneurs trying to navigate the complexity of the Federal and state government programs for coronavirus stimulus and relief.

1. When must I spend the PPP funds and when does the 8-week time period begin?

Businesses have 8 weeks to spend the loan money on qualifying expenses; the 8-week clock starts ticking the day you receive the funds from the bank. For example, if you receive your funding on April 30, then all money must be spent by June 24 regardless of your pay period or reopening dates. It remains unclear if Congress intended a cash- or accrual-based method of accounting since the CARES Act language refers to “costs incurred and payments made during the covered period.”

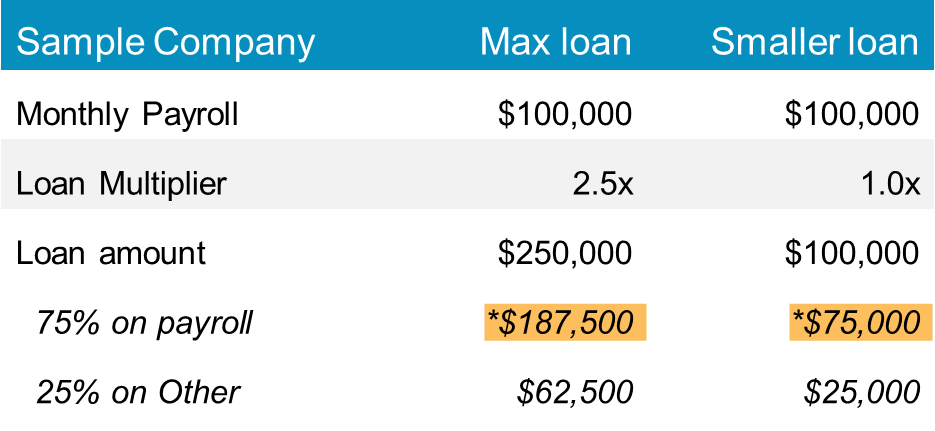

In light of the rules and finite time period with which businesses have to use the funds, experts recommend that you don’t overreach when requesting a loan amount. In other words, don’t borrow more than you think you can pay in payroll for 8 weeks. Your business is not required to request the maximum loan amount equivalent to 2.5x your monthly payroll. Instead, consider requesting a smaller amount as illustrated in the table below.

It’s also worth noting that on April 29, the AICPA requested that the 8-week period covered under PPP should align with the beginning of a pay period as well as more flexibility to choose a spending start date—for example, when stay-at-home restrictions are lifted. However, there is currently no indication whether or not this request will be granted.

2. How does the PPP define forgivable expenses?The PPP stipulates that 75% of the loan amount must be spent on payroll, including salary and benefits, to employees with salaries of $100,000/year ($8,333/month) or less. This salary calculation includes employer-paid health insurance, 401k matching contributions, and state and local taxes on payroll like unemployment insurance; it does NOT include the employer-portion of payroll taxes including Social Security and Medicare.

Twenty-five percent of your PPP loan can be spent on other qualifying expenses including:

-

Rent obligations for payments under a lease agreement in force before February 15, 2020. This most likely refers to leases of real property such as office space, but could also include equipment rentals.

-

Utility bills for electricity, gas, water, transportation, telephone, and internet service beginning prior to February 15, 2020.

-

Interest for covered mortgage obligations on “real or personal property”

3. How do I determine headcount changes for loan forgiveness and what happens if my business tries to a rehire a laid-off employee, but they reject our offer?

The following formula should be used to calculate the impact of headcount changes on PPP loan forgiveness:

The number of full-time-employees (FTEs) during the 8-week covered period divided by the average # of FTEs per month from February 15, 2019 to June 30, 2019 or the average # of FTEs per month from January 1, 2020 to February 29, 2020.

According to a new FAQ issued by the SBA on May 3, 2020, businesses that received PPP loans can exclude laid-off employees from loan forgiveness calculations if the employee turns down a written offer to be rehired (for the same salary/wages and number of hours). The SBA also warned that employees who reject offers of reemployment may be ineligible to continue receiving unemployment benefits though it’s unclear how this will be enforced.

4. How do wage changes affect loan forgiveness?

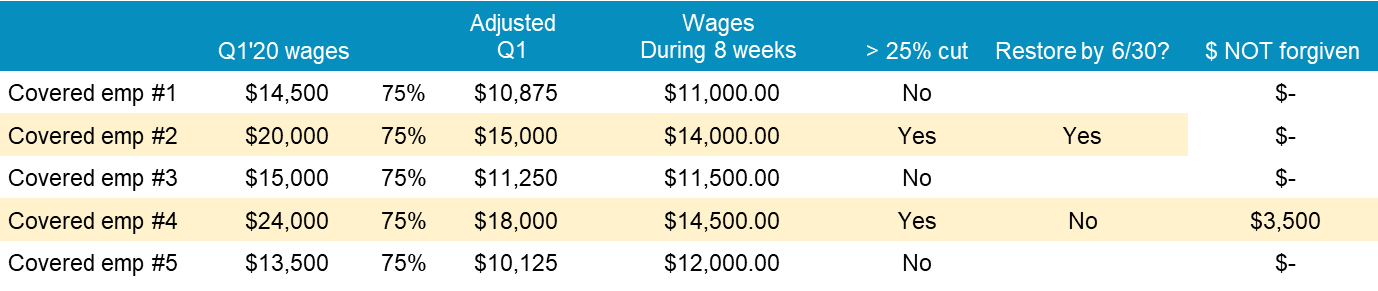

To ensure maximum loan forgiveness, all businesses will have until June 30, 2020 (regardless if your 8-week period ended prior to that date) to restore full-time employment and salary levels for any changes made between February 15, 2020 and April 26, 2020. However, if your business is unable to fully restore wages, the following loan forgiveness calculation should be used (see table below for an example):

-

Compare each covered (< $100,000k wages) employee’s wages during covered period to wages during Q1’20

-

For any covered employees who dropped by more than 25%

-

Multiply the first quarter wages or salary by .75

-

Subtract the product from the covered period wages or salary

-

-

The aggregate dollar amount calculated as set forth above will reduce the loan forgiveness amount.

5. How does the PPP application certification affect my loan forgiveness?

There is a fair amount of concern surrounding the certification language on the PPP loan application. Specifically, experts are concerned about the following statement: “Current economic uncertainty makes this loan request necessary to support the ongoing operations of the applicant.” After high-profile companies like Shake Shack and Ruth’s Chris Steakhouse were found to be the recipients of PPP loans, additional clarification was issued regarding the definition of loan eligibility and some loans were returned. Moving forward, the SBA announced it intends to review individual PPP loan files to ensure compliance. If a loan is found not to be necessary, the business could incur criminal fines of up to $1 million and imprisonment.

On May 5, the SBA extended the safe harbor repayment date for loans already disbursed to May 14 and intends to provide additional guidance on how it will review certification. If you’re unsure whether or not your business clearly meets the hardship standard, it’s important to seek competent advice from experienced legal counsel.

Get help during unprecedented times

Learn more about small business stimulus funding and discover best practices for payroll and HR during the COVID-19 pandemic. Asure offers free resources to help you in the midst of constant changes including webinars, loan information and guidance, free HR services and paycards, discounted COBRA services, and CARES-PPP payroll reports for funding requests and loan reimbursement.